Gas mileage compensation calculator

For example if the standard reimbursement vehicle gets 225 mpg. Then we divide the MPG by the fuel costs updating the fuel price factor each month for their location.

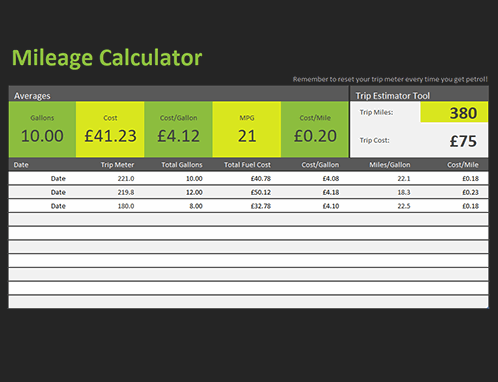

Mileage Calculator

MINI Cooper SE Hardtop 2 door.

. Input the number of miles driven for business charitable medical andor moving purposes. For a location missing from the drop down type a street. To determine what your business miles are worth multiply the miles driven by the mileage rate set by your employer.

Rate per mile. If use of privately owned automobile is authorized or if no Government-furnished automobile is available. Reimbursements based on the federal mileage rate.

The new rate for. For example if Car 1 gets 25 MPG Car 2 gets 20 MPG gas costs 320 per gallon. The IRS sets a standard mileage reimbursement rate.

Then see the miles you have traveled that year. For example lets say you drove 224 miles last month and your employer. After you have filled out all the fields hit calculate and the calculator will tell you the gas costs for each car.

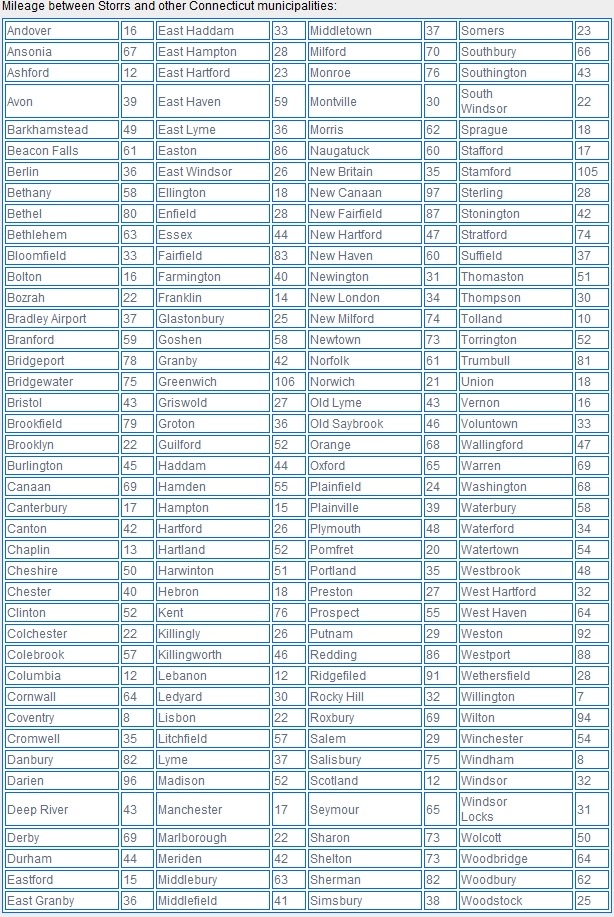

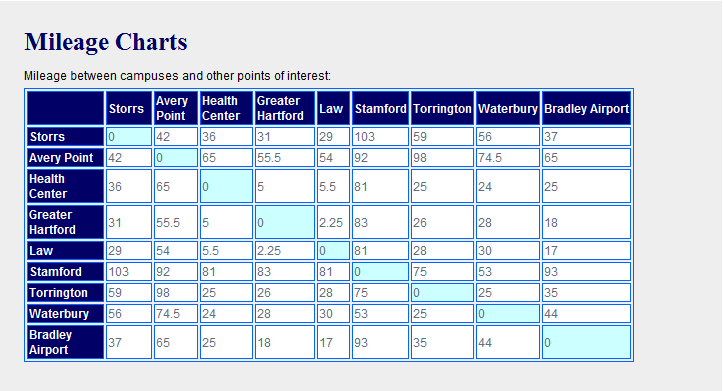

Then look for the standard rates of that year. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the. Type the location name in the From and To fields.

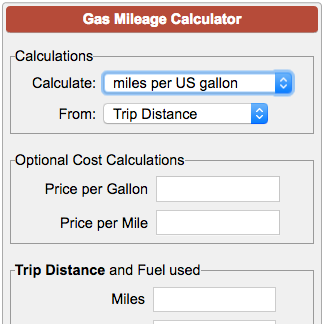

Gas mileage will improve by 1. Click on the Calculate button to determine the. Select the location from each drop down.

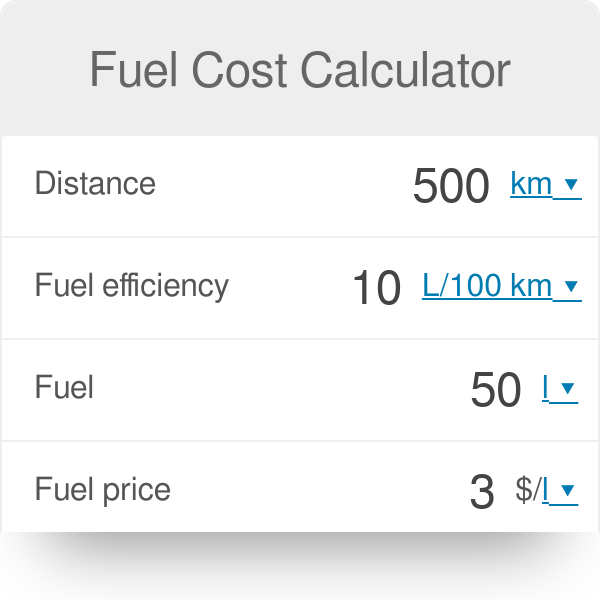

Firstly see the tax year you need to calculate the mileage reimbursement. This free fuel cost calculator estimates the fuel cost of a trip based on fuel efficiency distance and gas price using various units of measurement. This script determines the compensation due from a number of miles driven based on a mileage fee of a set amount.

For 2020 the federal mileage rate is 0575 cents per mile. Use the Gas Mileage Calculator. Select your tax year.

A simple gas trip calculator to estimate how much fuel your vehicle consumes and uncover if your car is a gas guzzling machine. 15 rows Standard Mileage Rates. This calculation can be in US dollars on any other amount of money.

The only gas mileage calculator that calculates gas mileage and toll costs across states in United States and provinces in Canada. Use for gas calculator gas mileage IFTA tax truck gas. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year.

Log your mileage and gas expenses using this gas mileage tracker template that calculates the average price per gallon miles per gallon and cost per mile.

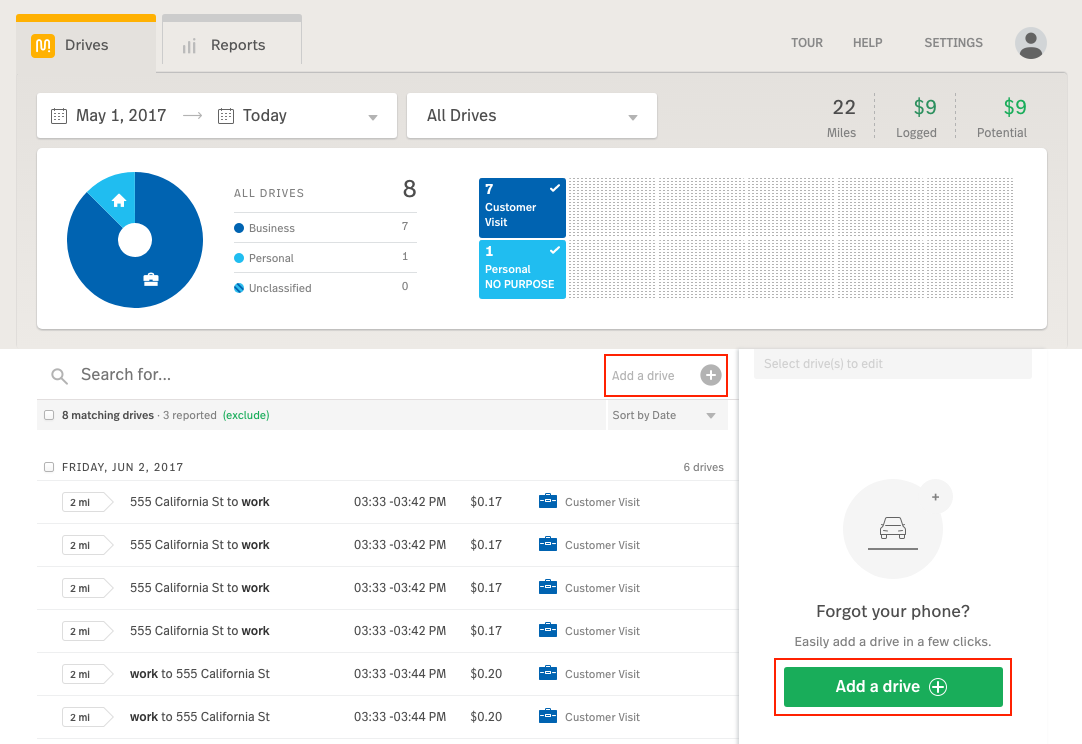

Mileage Calculator Credit Karma

How Do I Submit Or Claim Mileage In Concur Expense Sap Concur Community

The 5 Best Mileage Tracker Apps In 2022 Bench Accounting

Gas Mileage Log And Mileage Calculator For Excel

2021 Mileage Reimbursement Calculator

Fuel Cost Calculator

2022 Mileage Calculator Canada Calculate Your Reimbursement

Mileage Reimbursement Calculator

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Mileage Calculation Accounts Payable

2022 Mileage Calculator Canada Calculate Your Reimbursement

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

Mileage Calculation Accounts Payable

Free Mileage Log Template For Excel Everlance

Gas Mileage Calculator

Gas Mileage Log And Calculator Gas Mileage Mileage Log Printable Mileage Chart